Introduction

In today’s fast-paced world, owning a reliable vehicle is not just a convenience—it’s often a necessity. For many, the journey to car ownership begins with securing a car loan that fits within their financial means. This case study explores how Mark, a Melbourne resident, successfully navigated the complexities of obtaining a car loan with the help of Optimal Loans. The case study highlights the challenges faced, the tailored solutions provided, and the positive outcomes achieved, offering valuable insights for others in similar situations.

Client Profile

Name: Mark

Location: Melbourne, Victoria

Age: 35

Occupation: Marketing Manager

Financial Status: Moderate credit score, stable income, and a young family to support.

Initial Need

Mark had been relying on public transport and occasional ride-sharing for daily commuting. However, with a growing family and increasing work responsibilities, the need for a personal vehicle became evident. The challenge was to find a financing solution that would allow them to purchase a reliable car without straining their monthly budget.

Challenges Faced

Credit History: Although Mark had a stable income, their credit score was only moderate due to past financial decisions, which posed a challenge in securing favourable loan terms.

Budget Constraints: The client was looking for a car that met the family’s needs while ensuring that the monthly loan repayments were within a strict budget.

Market Conditions: At the time, the car market in Melbourne was competitive, with fluctuating interest rates and varying availability of vehicles, making it crucial to act quickly once a suitable loan offer was found.

Solution Provided

Loan Type: Optimal Loans offered a tailored car loan with competitive interest rates and flexible repayment terms. The loan was structured to accommodate the client’s budget while ensuring that the total cost of borrowing remained low.

Financial Planning: The financial advisor from Optimal Loans worked closely with Mark to assess their financial situation. Together, they chose a loan term that provided manageable monthly payments, while also considering options for early repayment without penalties.

Approval Process: Despite the initial concerns about the client’s credit score, Optimal utilised its comprehensive understanding of the client’s financial stability to secure loan approval. The process was expedited to ensure that Mark could take advantage of a time-sensitive deal on the desired vehicle.

Outcome

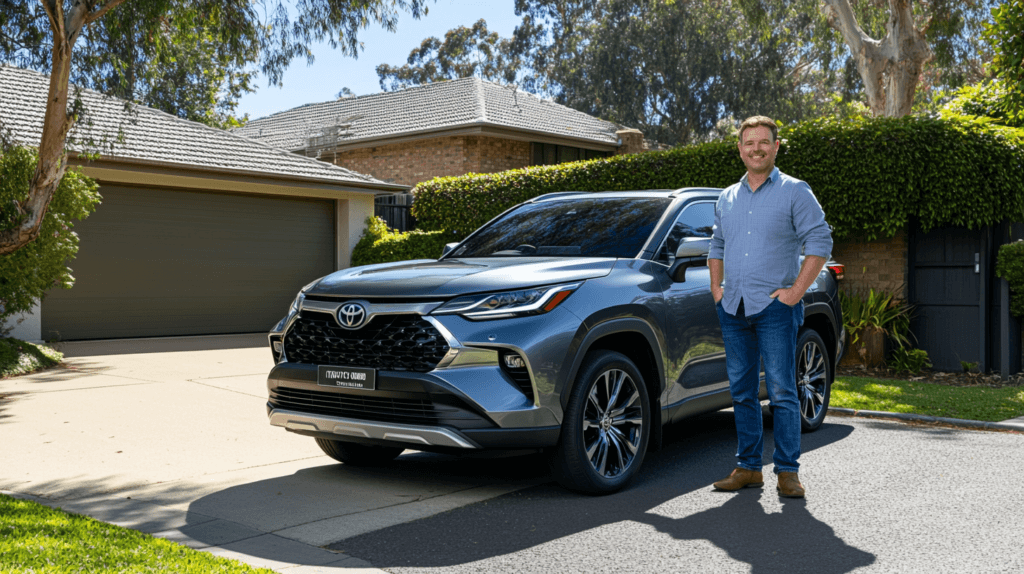

Vehicle Purchase: Mark successfully purchased a 2021 Toyota Kluger that perfectly met the family’s needs. The car provided the much-needed convenience for daily commuting and family activities.

Financial Impact: The structured loan allowed Mark to manage repayments comfortably, leading to improved financial stability. Over time, consistent repayments contributed to an improved credit score, opening doors to better financial opportunities in the future.

Customer Feedback: Mark expressed high satisfaction with the service provided by Optimal Loans. The client appreciated the personalised approach and the clear communication throughout the process, which made the experience stress-free and rewarding.

Lessons Learned

This case study demonstrates the importance of tailored financial planning when securing a car loan. For individuals with moderate credit scores, working with a financial service provider that offers flexible terms and a personalised approach can make a significant difference. Additionally, acting quickly and making informed decisions in a fluctuating market can help secure the best possible deal.

Conclusion

The successful partnership between Mark and Optimal Loans highlights the value of strategic financial support in achieving car ownership. By addressing the client’s unique needs and providing a customised loan solution, Optimal Loans enabled Mark to drive financial success—literally and figuratively. This case study serves as a testament to the benefits of using a loan to kickstart not just a business, but a better quality of life.